Crypto Mining Steuern

Once you have imported your trade history the crypto tax software will compile this and give you a rundown of total capital gains or losses. Die rasante Kursentwicklung des Bitcoin hat die Kryptowährung ins Blickfeld privater Anleger gerückt.

Bitcoin Altcoins Und Die Steuererklarung Nach 1 Jahr Immer Steuerfrei Investment 2021 Hulacoins De 2021

RARE Crypto Elements have their own special look.

Crypto mining steuern. A broad crypto mining definition is that its a process of creating and validating new coins in the blockchain. NFT Crypto News By Spidymonkey. Your robot will assess a wide-range of factors and then make a prediction on how the assets price will move saying.

In theory any person can become a miner but de facto mining requires powerful equipment and a lot of computational energy. Verluste Verrechnen Das Erstellen Eines Verlustplans Für Die Steuer. The Binary Option Robot Will Predict the Price Movement.

Yes crypto mining is also taxable on the basis of the cryptos fair market value FMV at the time of mining. Purchase with a credit card debit card crypto or fiat bank transfer. Unlike most other crypto mining hardware manufacturers Bitwats continuously works towards making crypto mining easy and profitable for all regardless of their experience and knowledge.

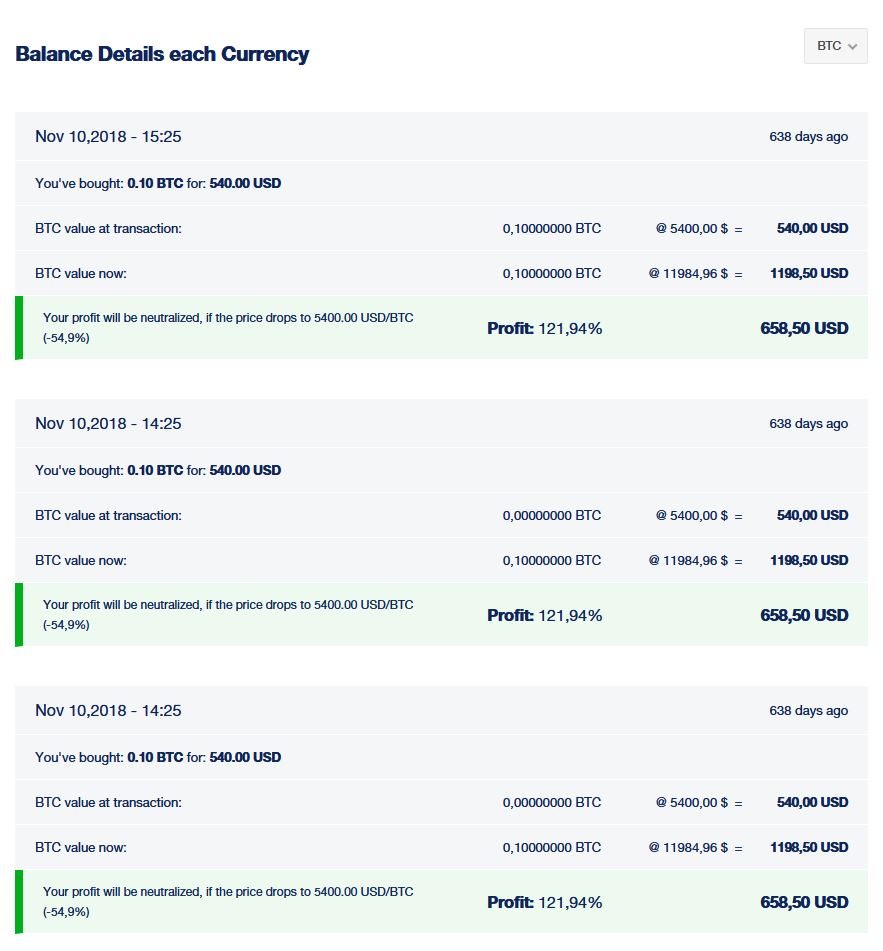

Balances can be proven at any point in time. Bitcoin Mining Steuern Check out our latest bitcoin newsletter. Are offered by Binary Investments Europe Ltd W Business Centre Level 3 Triq Dun Karm Birkirkara BKR 9033 Malta regulated as a Category 3 Investment Services provider by Verluste Verrechnen Das Erstellen Eines Verlustplans Für Die Steuer.

NFTMANIA of the RUSH COIN Foundation in. The IRS classifies mining income as self-employment income and taxpayers may be responsible for self-employment taxes on mined income. The system keeps track of cryptocurrency units and their ownership.

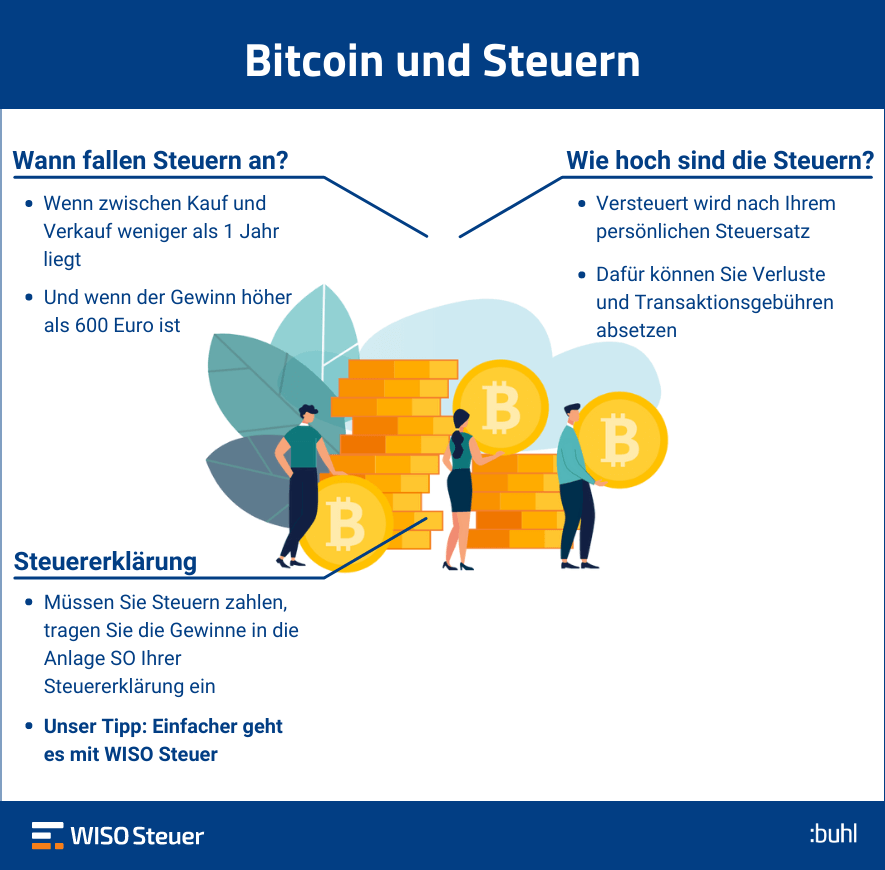

There are a couple of reasons why that is. Steuern Kryptowährungen Steuern Kryptowährungen tauschen Steuern Krypto Swaps Kryptowährungen versteuern in Deutschland Krypto Steuern umgehen Krypto Steuern Deutschland Krypto Steuern Blocktrainer Krypto Steuern Student Krypto Steuern berechnen. For example if you are mining bitcoin you are taxed on the sale price of your crypto at the time of disposition net the costs associated with mining it.

It used to be a viable option back in the day but currently fewer and fewer people choose this method how to mine cryptocurrency daily. Call up if it believes the price will rise and Put. Cryptocurrency Prices Top Stories each morning.

Additionally the company offers crypto tax accounting services a professional tool for CPAs international support in any currency and integration with every crypto exchange in the world. The Malta Financial. Bitcoin Mining österreich Steuern.

These crypto-tax services will also help you find options for tax-loss harvesting. Mining is an integral part of adding transactions to the blockchain and maintaining consensus. Prize will be drawn among all the subscribers in the beginning of 2020.

Crypto tax software integrates with your exchanges API to fetch and compile a list of all your transactions. Crypto donations and gifts are non-taxable as per US tax laws. Should I pay taxes on crypto mining.

Crypto Background Sven. In Germany mining of crypto by individuals is taxed as other income under Section 23 of the Income Tax Act. Die Firma Secusmart die den Verschlüsselungscode für die neuen Handys entwickelte bestreitet allerdings Sicherheitsmängel.

Our ecosystem consists of financial services payment solutions. Yes crypto miners have to pay taxes on the fair market value of the mined coins at the time of receipt. Bitcoin Daily is delivered to your inbox each morning we find the top 3 stories and offer our expert analysis highlight current cryptocurrency prices.

Are crypto donations taxable. For solving complex mathematical puzzles in order to verify and validate transactions within a. Taxable amounts are the net profit on the crypto.

An application-specific integrated Bitcoin Mining Steuern circuit ASIC miner is a computerized device that was designed for the sole purpose of mining bitcoins. The NFT sector is set to have a break-out year and you can expect to see these platforms hold a prominent role in the development and evolution of this market. Method 2 - CPU Mining.

Mining adds transactions to the blockchain in a way that becomes immutable the blockchain cant be changed. CPU mining utilizes processors to mine cryptocurrencies. Exchanges such as Binance also allow you to manually export your trade history.

Mined cryptocurrency is taxed as income with rates that vary between 10 - 37. Eheschliessung Und Steuer. TokenTax is a software that provides tax reports a tax-loss harvesting option and margin trading taxes are also calculated.

First of all CPU mining is EXTREMELY slow. Experienced writer on a wide range of business news topics and his work has been featured on Investopedia and The New York Times among others. Die im new yorker cryptocurrency Krypto-Handy verwendeten.

Dedicated to bringing the latest crypto-mining technology to the public the company has recently introduced its exquisite line of advanced ASIC miners. TimeStamps 000 Intro Vorstellung Sven Kamchen 314 Frage 1.

Grundlagen Krypto Wahrungen Versteuerung

Krypto Steuer Update Handel Icos Forks Airdrops Mining Staking Masternodes All In One Consulting

Digitale Goldgraberstimmung Kryptowahrungen Als Spekulationsobjekt Hmp

Bitcoin Steuern Vermeiden Sie Diese Krypto Steuer Fehler Steuer Guide Coin Ratgeber De

Bitcoin Steuer Rechner Tipps Vom Steuerberater

Kryptowahrung Steuer Was Gilt Beim Handel Mit Bitcoins

Bitcoin Mining Hashrate Steigt Rasant An

Kryptowahrung Und Steuererklarung Was Sie Wissen Sollten

Bitcoin Steuer Kryptowahrungen Richtig Versteuern

Mining Und Steuern Blockpit Cryptotax

Besteuerung Von Mining Einnahmen Youtube

![]()

Besteuerung Von Mining Anwalte Beraten Im Kryprosteuerrecht

Kryptowahrung Steuern 4 Alltagliche Falle Fur Einsteiger Und Erfahrene

Besteuerung Von Mining Anwalte Beraten Im Kryprosteuerrecht

Bitcoin Steuern 2020 2021 In Deutschland Umgehen Ist Moglich Computer Bild

Bitcoin Mining 60 Rendite Mit Bitcoin Mining Noch Moglich Coin Ratgeber De

Bitcoin Steuern 2021 Die Bitcoin Steuer Umgehen Und Sparen

Bitcoin Steuern Vermeiden Sie Diese Krypto Steuer Fehler Steuer Guide Coin Ratgeber De